Online Cash Registers

In accordance with the Federal Law No. 54-FZ

Federal Law No. 54-FZ on the Application of Cash Register Equipment in Settlements of Accounts in the Russian Federation

- The use of new-style cash registers for offline and online sales is mandatory from 2017

- New cash registers shall be connected to the Internet at all times in order to submit data to the Federal Tax Service

- Each cash register shall be equipped with a fiscal accumulator designed for a limited number of transactions. Normally, it must be replaced every 12, 15, or 36 months

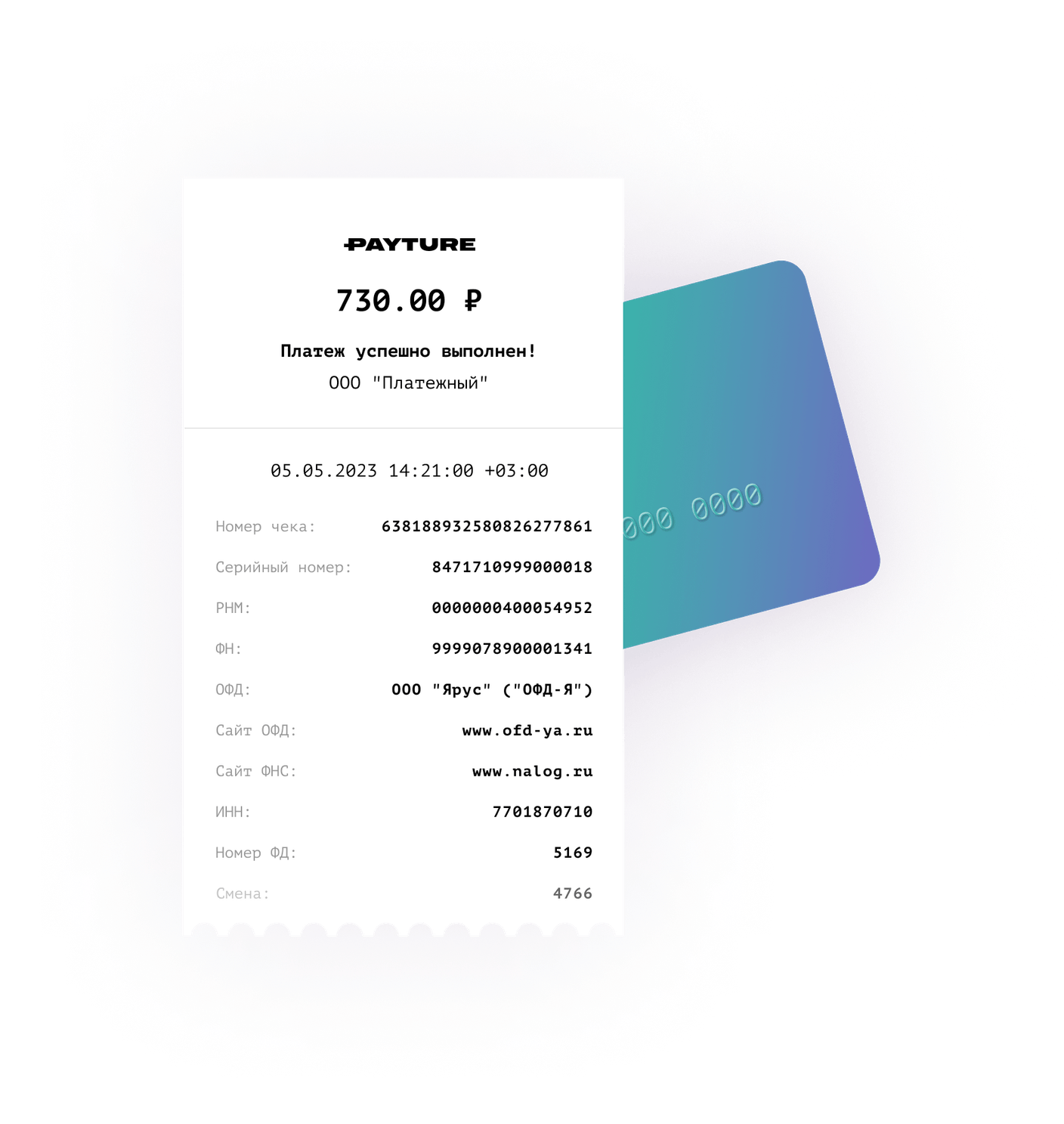

- A receipt, including an electronic one, shall contain full information about the goods purchased, the VAT rate, and a QR code for verifying the receipt in the mobile application of the Federal Tax Service.

- If you only sell online, you can use an online cash register, which is not designed for printing receipts. A virtual receipt is sent to the buyer’s email address or phone number.

Use trusted services

for online sales

We are confident in the reliability

of the services we work with

Orange Data / ATOL

The best solution

- Cash register rental and payment for all sorts of payments, including those made using alternative payment methods, third-party services, and widgets

- Access to a personal account with detailed statistics on turnover and the option to issue refunds and write-downs

- Fraud prevention: Payture’s own advanced anti-fraud software can eliminate losses on fraudulent chargebacks and improve the company’s reputation

- Guaranteed high uptime and protection against failures due to reserved server space reservation and hardware installation executed by our partners

- Easy and convenient payments on the website or in the app, flexible approach to integration, no red tape and no headaches: we will take care of all the matters regarding setup and development