Choose payment methods

directly in your personal account Payture Lite

A ready-made solution

for quick start

Ideal for sole proprietors and legal entities registered in Russia

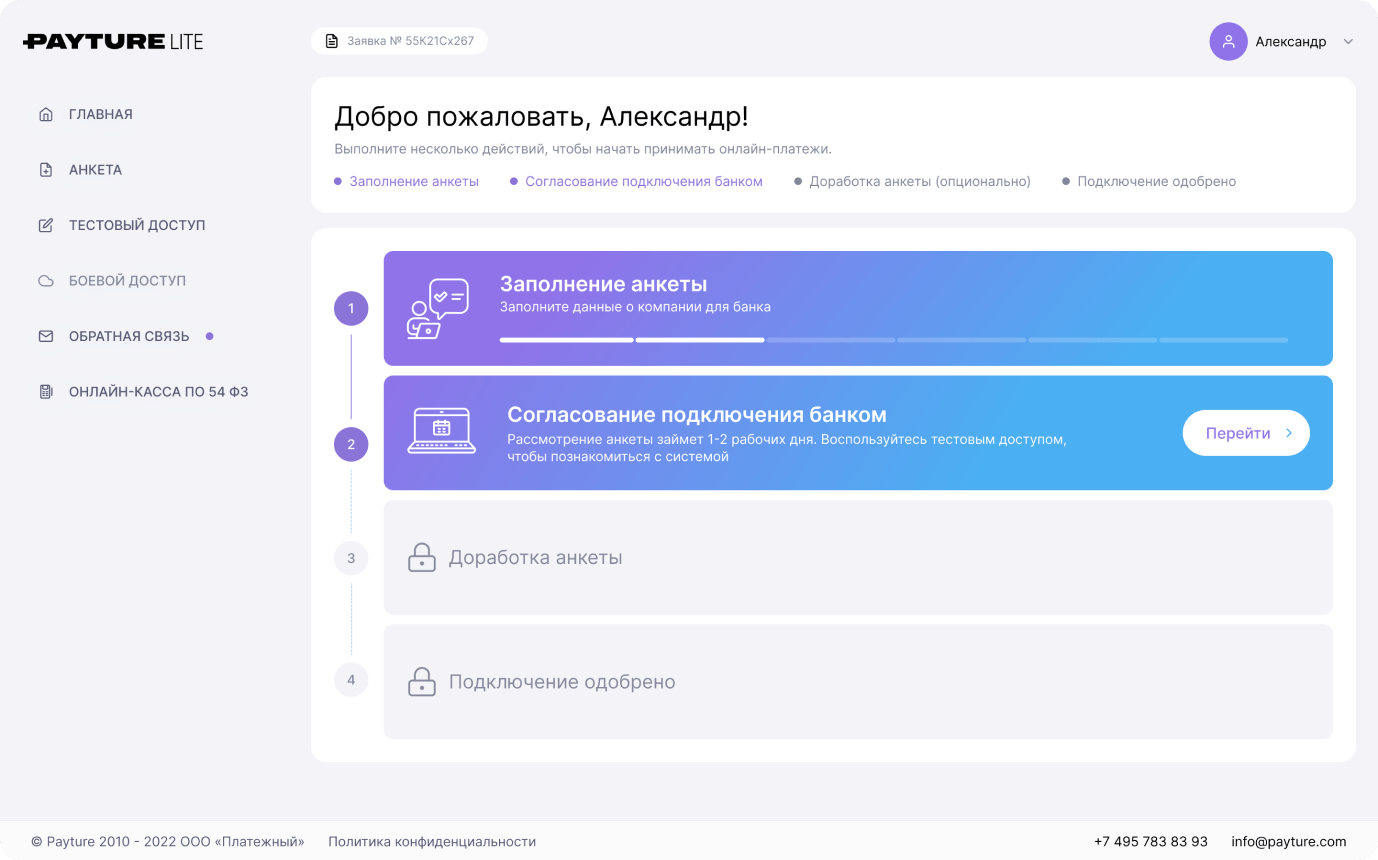

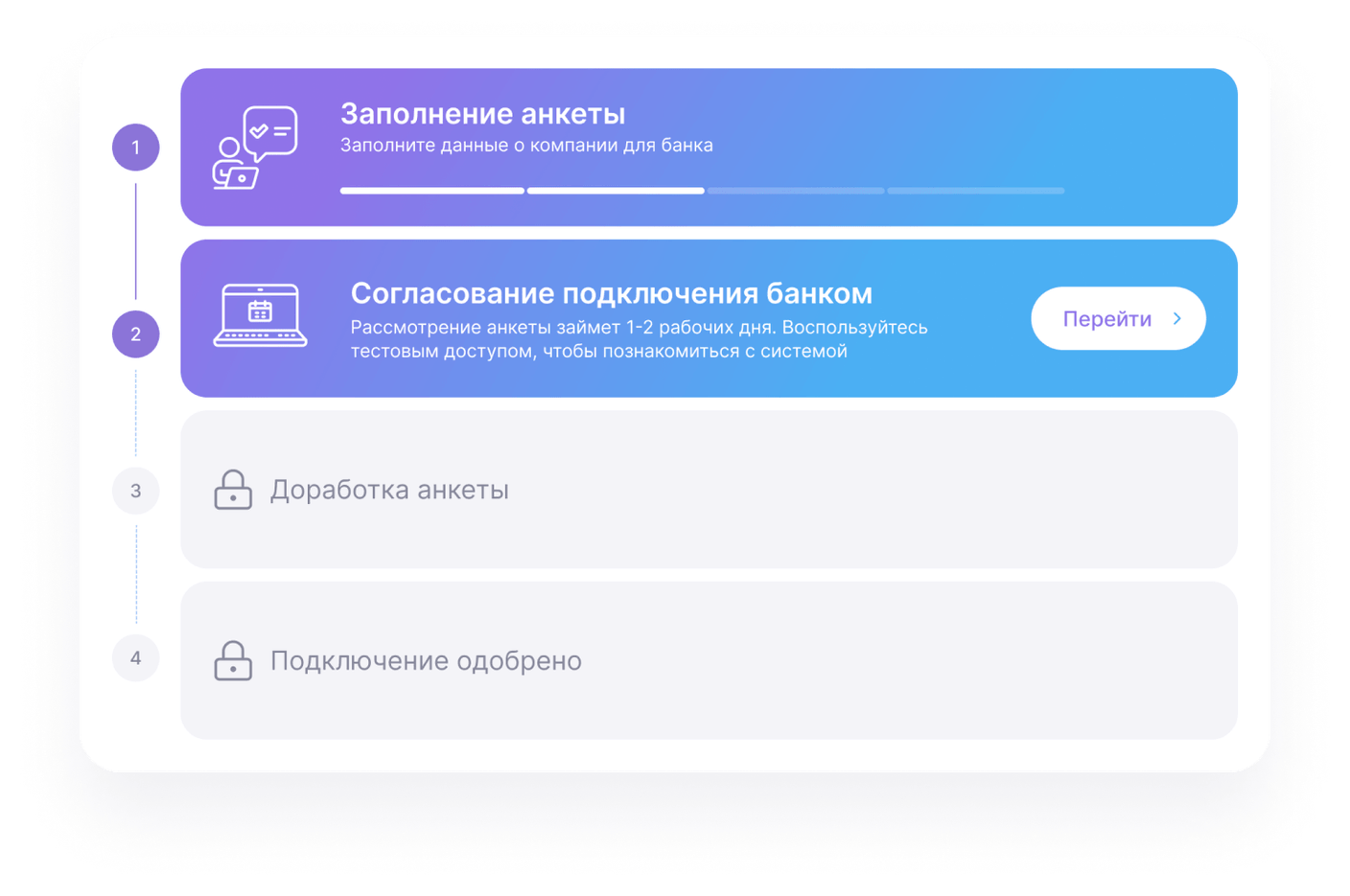

Easy setup

Fill out the application form

Test the system while the bank reviews

your applicationGet access to the system and start accepting online payments!

Plans

EasyStart

Turnoverfrom 0 to 3 mlnRate3.2%Basic

Turnoverfrom 3 to 5 mlnRate2.8%Optimal

Turnoverfrom 5 to 10 mlnRate2.7%Advanced

Turnoverover 10 mlnRateCalculated

individually

Advantages of Payture Lite

No lengthy

approval processesAs the process is fully automated, you can quickly fill out the necessary documents, send them

to the bank for approval, and receive terminals

for further integration right afterFast integration

The integration process will take no more than 30 minutes: all you need to do is copy a couple

of lines of code

Our widget is a pop—up window that allows

the customer to make a purchase on your site,

without switching to third-party servicesOne-touch payments

Increase your conversion rate by accepting payments with a single touch, just the way top payment services do. Payment details

are automatically retrieved from the user’s account

FAQ

What banks are your partners in implementing payment solutions?

What is the commission rate, and what does it depend on?

How long does it take to implement a payment solution from start to end?

Where and how often will the bank transfer reimbursements?

Are there any additional charges?

Is the commission refunded if a customer returns the product?

How can I connect an online cash register to an online terminal so that receipts are automatically sent to the users?

Where can I view payment statistics?

What if my monthly turnover exceeds ₽5 million?

What do I do if the bank has rejected my application?

Who do I contact if I still have questions about the payments setup?

Who do I contact if there are any problems with integration?

Who do I contact if there are any problems with accepting payments?

What form of business organization is suitable for Payture Lite?

Can I activate Payture Lite if I have a foreign legal entity?

![[object Object]-icon](/_next/static/media/t-pay.84a78bde.svg)

![[object Object]-icon](/_next/static/media/MirPay.1a61e90b.svg)