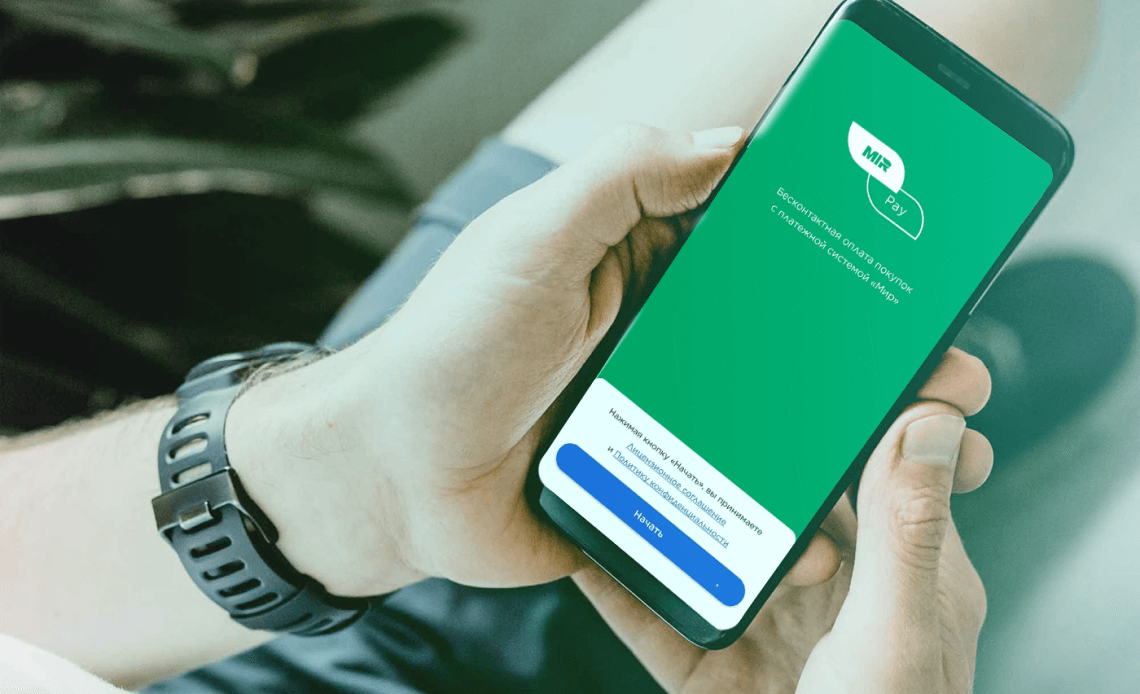

Mir Pay —

a powerful tool

to increase

audience loyalty

A convenient and secure technology for online shopping, Mir Pay allows your customers to pay for goods and services without entering card details

Why connect

- Secure paymentCustomers are not afraid that their card data will be stolen. With Mir Pay, card data is protected and not transmitted to third-party services - a special digital token is used instead of the card number

- Reduces abandoned cartsMore than 20% of shoppers do not complete a purchase due to the lack of fast payment methods or not having a card on hand. Mir Pay can solve this problem - only the app is needed for payment

- Error-free paymentCustomers confirm payment through the Mir Pay app. They do not enter card details and SMS code, so payments will no longer be canceled due to typos

Over 50% of the market

The share of the Mir payment system in the total volume of domestic operations exceeded 50% in 2024

How online payment with Mir Pay works

- 1The customer clicks the Mir Pay button

- 2Selects one of their cards in the Mir Pay app

- 3Confirms the payment using a fingerprint or PIN code

- 4The purchase is paid. The customer returns to your website

FAQ

Where can I connect payment via Mir Pay?

How much does the connection cost?

How long does it take to connect?

How is Mir Pay different from Sber Pay?

Is it suitable for self-employed?

How to use Mir Pay for purchases?

Is it possible to make payments via Mir Pay without internet access?

Which banks support Mir Pay?